From AI Integration to Sustainable Finance, the Financial Landscape Undergoes Transformative Shifts

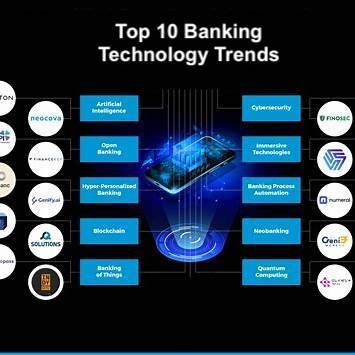

As we progress through 2025, the financial sector is experiencing significant transformations driven by technological advancements, evolving consumer expectations, and global economic shifts. Key trends such as the integration of artificial intelligence (AI), the rise of sustainable finance, and the proliferation of fintech solutions are redefining the industry.

Artificial Intelligence Revolutionizing Finance

AI’s influence in finance has expanded beyond basic automation to more sophisticated applications. Financial institutions are leveraging AI for enhanced fraud detection, risk management, and personalized customer experiences. Advanced AI models analyze real-time data to identify fraudulent activities and assess credit risks more accurately. Additionally, AI-driven chatbots and virtual assistants are improving customer service by providing instant, tailored responses to inquiries. The integration of AI is not only streamlining operations but also creating new revenue streams through innovative financial products and services.

Emphasis on Sustainable Finance

Sustainability has become a central focus in financial decision-making. Investors and institutions are increasingly prioritizing environmental, social, and governance (ESG) factors. This shift is evident in initiatives like the International Monetary Fund’s (IMF) Resilience and Sustainability Trust, which aims to provide long-term financing for climate-related projects. For instance, Pakistan is in discussions with the IMF to secure approximately $1 billion for climate resilience efforts. This trend reflects a broader movement towards aligning financial practices with global sustainability goals.

Fintech Expansion and Consumer Empowerment

The fintech sector continues to grow, offering consumers more tools to manage their finances. The adoption of personal finance apps has surged, with millions of downloads occurring daily. These applications provide services ranging from budgeting assistance to investment management, granting users greater control over their financial well-being. The convenience and accessibility of fintech solutions are reshaping consumer expectations and driving traditional financial institutions to innovate.

Challenges in Traditional Banking

Traditional banks are facing challenges amidst this evolving landscape. Lloyds Banking Group, for example, reported a 20% decline in annual profits, partly due to substantial provisions for compensation related to a motor finance mis-selling scandal. The bank has set aside an additional £700 million, bringing the total provision to nearly £1.2 billion. This situation underscores the importance of transparency and regulatory compliance in maintaining consumer trust and financial stability.

Technological Integration and Cybersecurity

The rapid adoption of digital technologies necessitates robust cybersecurity measures. As financial services increasingly rely on cloud computing and AI, protecting sensitive data from cyber threats has become paramount. Institutions are investing heavily in cybersecurity infrastructure to safeguard against sophisticated attacks, ensuring the integrity and resilience of financial systems.

Conclusion

The financial industry in 2025 is marked by dynamic changes driven by technology, sustainability, and evolving consumer behaviors. Embracing AI and fintech innovations, committing to sustainable finance, and strengthening cybersecurity are pivotal for institutions aiming to thrive in this transformative era. As these trends continue to unfold, stakeholders must adapt proactively to navigate the complexities of the modern financial landscape.

Deja una respuesta