Compound Interest Calculator

What is Compound Interest?

Compound Interest is a method of calculating interest where the interest earned is added to the principal, and subsequent interest calculations are based on the new total amount. Unlike simple interest, which is calculated only on the original principal, compound interest allows the interest to accumulate, meaning that interest is earned not just on the principal but also on any previously accumulated interest.

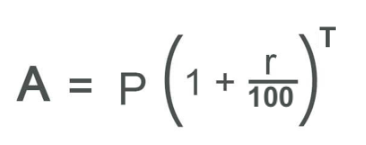

Compound Interest Formula:

The formula to calculate compound interest is:

Where:

- A = Amount (the total value of the investment or loan after interest)

- P = Principal (the initial amount of money)

- R = Rate of Interest (annual interest rate in percentage)

- T = Time (the number of years the money is invested or borrowed for)

- A – P = Compound Interest (the interest earned or paid)

How it Works:

In compound interest, the interest is calculated on the principal and any previously earned interest. Over time, this results in «interest on interest,» which can significantly increase the total amount over long periods.

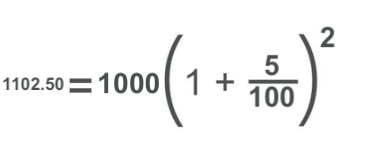

For example, if you invest €1,000 at an interest rate of 5% for 2 years, the compound interest would be:

So, after 2 years, your total amount would be €1,102.50, and the interest earned would be:

1102.50 – 1000 = 102.50 (€)

With compound interest, the interest earned is greater compared to simple interest because the interest is compounded on both the principal and accumulated interest.